Welcome to part four of "Tuning Your Pricing Strategy: A 5-Part Guide." I'm here to guide you through the labyrinth of pricing to achieve optimal results. To gain a better understanding of the series, review the roadmap (image below). Newcomers can access previous installments at the bottom of this page.

Developing a Competitive Pricing Strategy: Essential Techniques for Success in Every Market

In the previous article (#3) on value-based pricing, the willingness to pay (WTP) of a customer was evaluated through the example of Darby's potential purchase of a robot vacuum. It was concluded that Darby has a high WTP for the product.

Darby is currently struggling with "analysis paralysis" due to the overwhelming amount of product options available. To illustrate this, take a look at the following data:

Product price range: Approximately $150 to $1,500

Number of brands: 30+

This becomes a challenge for Darby as the buyer and the sellers!

Assisting Darby in Overcoming "Analysis Paralysis" with Competitive Pricing

Darby has chosen to prioritize these features and evaluate how competitors compare before making a purchase:

Run time

Wi-Fi/cellular connectivity

Noise level

Ease of use

Cleaning effectiveness

Battery life

Warranty

Competitive pricing strategy is crucial for attracting customers. It involves identifying competition, evaluating their offerings, and considering customer perception and willingness to pay.

Challenges of Pricing with Limited Customer or Cost Data

Our pricing strategy series has so far delved into two techniques: value-based pricing and cost-based pricing. However, these methods may not be practical when data is scarce. Here are some scenarios to consider:

As a startup, you may not have a clear understanding of your variable and fixed cost structures yet, making cost-based pricing impractical.

If you're introducing a new product or service that has been kept under wraps, you may not have enough insights on customer willingness to pay for value-based pricing to work.

Put simply, gathering competitive pricing data and conducting analysis can yield significant benefits.

Adopting Jeff Bezos' Approach to Competitor Analysis for Your Pricing Strategy

"We watch our competitors, learn from them, see the things that they are doing for customers and copy those things as much as we can." -Jeff Bezos (Founder of Amazon)

To put these ideas into practice, we will focus on two important steps:

We’re going to focus on identifying competitors so we know who to monitor, evaluate, and copy! This includes two “mini examples.”

We’re going to focus on the evaluating, learning and copying! Throughout this step, we will use a couple techniques and examples to gain insight into the customer's point of view.

By mastering the art of competitive pricing, you'll have the power to charm customers with perfectly-priced products and services.

Introducing Myself as Your Guide to Competitive Pricing Strategy

Before we delve into the details, let me assure you that I have the necessary expertise to direct you towards the right path. I hold an MBA from Chicago Booth, where my concentrations were in Strategy, Entrepreneurship, Finance, and Organizational Behavior. Additionally, my enthusiasm for pricing strategy led me back to Booth, where I took a course on this subject taught by Jean-Pierre Dubé. In this article, I highlight some of the key concepts covered in the class.

BEFORE Analyzing Competitive Pricing Strategies, It’s Critical to Accurately Identify Competitors

To create a competitive pricing strategy, you must first identify your competitors and then analyze their prices. It's important to accurately identify your competition to ensure that the analysis is useful. Without this crucial step, the analysis won't provide any value. Let's focus on identifying competitors...

Identify Your Competitors (Even If You Think You Don't Have Any!)

This involves research, including identifying key players in your industry. No matter how unique you believe your product or service is, it's essential to recognize that you always have competition. Here are two mini examples to emphasize this point:

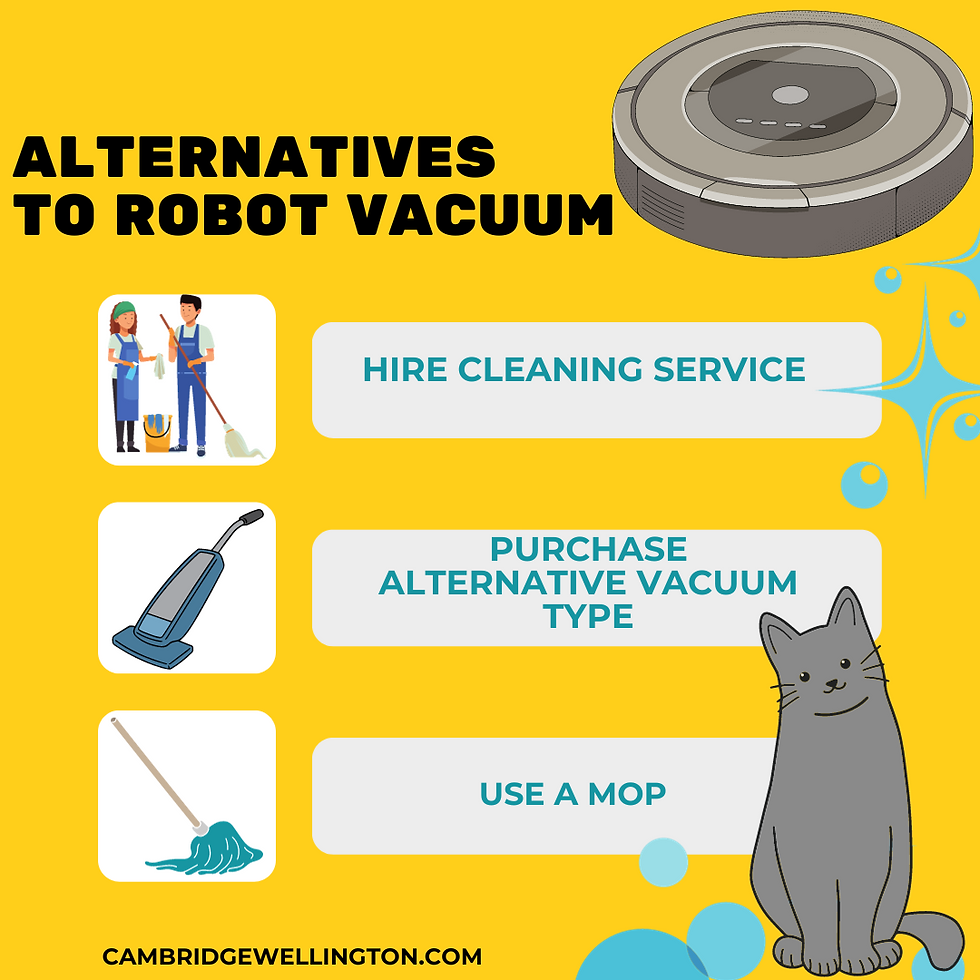

Customer Substitutes for the Robot Vacuum (Mini Example)

Envision this scenario: You're the brilliant inventor of the world's first robotic vacuum cleaner.

Even at the time of your invention, you had competitors popping up like whac-a-moles, offering alternatives to your customers, and they are still relevant today:

Hire a cleaning service that provides all materials (eliminating the need to own a vacuum and do the work)

Purchase a vacuum of a different type and explore second-hand options (to lower upfront costs)

If the floor is not carpeted, use a mop instead (cheaper than a vacuum and doesn't require power)

Customer Options for Group Outings (Mini Example)

Picture this: You're the only place in town where you can play Whirlyball, and you specialize in hosting group events like office socials and birthday bashes.

However, your customers have several other options to choose from, including:

Escape Rooms (can even be hosted remotely to accommodate virtual attendees)

Golf/mini golf (offers more flexibility than Whirlyball, which has a limit of 10 players per court)

Live Theater (a great way to support nonprofits)

Now that we better understand our competitors, we can proceed to analyzing their pricing strategies. By examining their pricing structures alongside other factors like service levels, we can make informed decisions. To help us with this analysis, we'll be utilizing frameworks with real-world examples. Let's dive in!

How to Conduct Competitive Pricing Analysis to Stay Ahead of Competition

A Quick & Simple Guide to Competitive Pricing: Method A (Explanation)

To begin, we'll explain a quick and easy-to-follow two step framework (with some fancy terminology). After that, we’ll offer an example that everyone can relate to – apartment prices.

Step 1: Establish the Reference Product & Its Reference Value

Identify the "reference product", which is the best customer substitute for your product or service (which can vary across customer segments)

Use the price of this "reference product" as the "reference value"

Step 2: Evaluate Differentiation Value & Apply it to the Reference Value

Identify the product's distinguishing factors, as perceived through the customers' willingness to pay (as explained in the previous article)

Then estimate the “differentiation value” based on how the customer perceives the value of the features that are different from the competitor

Take the “reference value” identified in Step 1, and then adjust the price (it may increase or decrease) based on the “differentiation value” determined above

Pricing Apartment Listing with Method A (Example)

I’m listing a 4 bedroom apartment, which is a unique item in the city, and I don’t have lots of time to conduct market analysis to set the listing price.

Step 1: Identify Closest Competitor to Apartment Listing & Its Price (Example)

Before searching, I establish the key factors in the eyes of customers are:

Location: The competitor's location should be within a one-mile radius of my listing.

Bedrooms: The competitor should have four bedrooms, the same as my listing.

Baths: The competitor should have two full bathrooms, the same as my listing.

Outdoor space(s): The competitor should also have outdoor space(s), the same as my listing.

Condition: The competitor's property should be in good condition, the same as my listing.

Then, I go online to identify the closest competitor to my listing. The unit that I identify meets all the key factors above and is listed for $4000, which becomes my “reference value.”

Step 2: Compare Features Between Listings to Set Price for My Listing (Example)

I identify some key distinguishing factors to consider:

Closest competitor has better natural light

Closest competitor is further from train line

Closest competitor does not offer private parking option

Closest competitor does not have new appliances (i.e. stainless)

Here are the steps to finding the price for the listing unit:

Begin with the closest competitor's listing price at $4000.

Add $100 to my listing price for more convenient public transit options (which is valued at a minimum of $25/week)

Add another $100 to my listing for updated appliances (better function and appearance), bringing the price to $4200.

However, to be fair, my unit has less natural lighting, so subtract $100 from my listing, which brings the price down to $4100.

Since there is a lot of time to rent the unit (the lease would begin in 3 months) and the landlords are A+ rated, we list at $4200. We can easily reduce the price if interest is lacking.

Since we've successfully tackled apartment pricing with a painless competitive pricing framework, let's shift to a more intricate framework, including a B2B scenario.

Comprehensive Competitive Analysis: Method B (Explanation)

Got some extra time to research competitive pricing strategies? Check out this plan: Rather than simply basing your prices on the closest competitor, scout out multiple contenders. Think of it as an approach that Darby would take to maximize the value of his robot vacuum investment.

Expanding Market Presence for Boutique Consulting Firm with a Website Launch: Method B (Example)

This time, let's examine the competitive options by looking at them through the buyer's lens. In this case, a boutique consulting firm is considering launching a website to expand their market presence, and the Founder is faced with lots of choices:

Outsource all aspects of website design, content creation, SEO research, and maintenance.

Outsource certain aspects of the website project.

Forgo the website entirely and invest time and/or money towards social media, paid ads, or other marketing avenues.

Step 1: Identify Competitive Products/Services for Website Launch (Example)

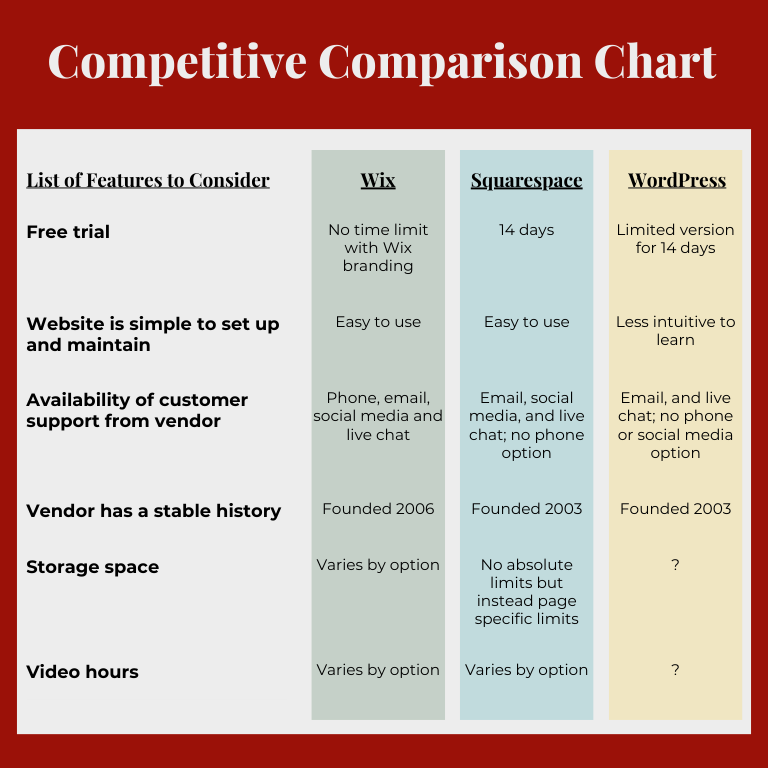

When considering website building options, the founder initially thinks of WordPress, but believes it may be too complex for her needs. To identify other options that might be more suitable for her small business, she jumps on g2.com to identify “website builder” options. After some research, she adds Wix and Squarespace to her list of potential options.

Step 2: Compare Website Builder Features to Make a Decision (Example)

Identifying Important Features

To support the analysis process, the Founder brainstorms a list of key factors that she values (assuming she does most of the work herself):

Ensuring website is simple to set up

Ability for website to become more intricate over time (i.e. events)

Simple maintenance (i.e. add new content)

Selecting vendor with a stable history

Strong mobile features for positive user experience

Availability of customer support from vendor and third-party options

Product direction/roadmap (plan to stick with the product for around 3 years)

Availability of Canva plug-in (ideal but not necessary)

Identifying Unnecessary Features

In addition, she creates a list of features that numerous products or services may provide but are not important to her, including:

Translation or additional languages beyond English

E-commerce capabilities

Constructing a Comparison Table

In order to compare website builder platforms, she utilized the brainstorm lists above to create a table that highlights the key features of the identified purchase options. For each key feature, she notes quantitative and qualitative data that is readily available.

During her evaluation process, she has identified several more features worth considering:

Availability of free trial

Storage capacity

Metrics and analytics

Video hours

Here are few methods to make a decision:

Compare Options by Assigning Feature Weights and Scores

Assign weights to each feature, totaling 100%. (This may vary depending on the customer segment/use case.)

Then assign a score to each product/feature. (This approach might work well for Darby’s robot vacuum where he can reference Consumer Reports, customer reviews, and ask friends about their product experiences.)

To determine which product offers the best value, calculate a score for each item and then compare it to its price. (If you’re lucky, the one with the highest score will be the cheapest. If not, you have to consider if the higher scoring options are worth the premium price.)

List Features in a Customer Journey Decision Sequence

To better understand the customer's decision-making process, try listing the features in the order of the customer journey decision sequence. This method can help identify which options buyers may eliminate early in the purchase evaluation process.

Here's how this method played out in real life:

The Founder of this boutique consulting firm tried the "free" version of each seller, attempting to create basic elements, such as a landing page.

With WordPress, the buyer felt "stuck" due to certain features being exclusive to the paid subscription. Furthermore, WordPress was flooding her inbox with multiple marketing emails every day.

Wix was quite user-friendly for the buyer who started building the website with gusto. Since the "free" version did not have a time limit, she had infinite time to experiment and could switch to the paid version (minus the Wix branding) when she was ready to launch. Of course, this was all contingent on whether or not she decided to go ahead with the website launch.

The buyer had heard good things about Squarespace from other small professional service firms; however, she found that some of the more nuanced options in Wix were not available in Squarespace and her trial was limited to 14 days, offering her less time to experiment with the platform.

After narrowing her options to Wix or Squarespace, the Founder delved into pricing, knowing that each brand has multiple options available with varying features for each. This is where the features like storage and video hours got considered.

For the features the founder needs, the prices were not significantly different. However, with Wix, the storage space seemed far simpler to understand. Ultimately, the Founder decided to stick with Wix as it gave her a zero-cost option with zero expiration until she decided to actually launch a website.

Keeping Up with the Competition: Monitoring & Dynamic Pricing

A key takeaway from the B2B website example is that the product with the most generous free trial won over a potential customer. The competitors were quickly left behind.

In the wild world of business, keep your eyes on the competition, especially new competitors. This is especially if you're using dynamic pricing. Stay on your toes and don't get caught off guard!

What’s Next: Our Last Stop on the Pricing Strategy Roadmap

Homework

For your organization’s pricing models, work through a competitive pricing analysis similar to the examples shared here.

Compare your results from cost-based pricing, customer value (as measured by willingness to pay), and competitive pricing.

If you have time, check around to ensure that you've gathered all relevant competitor data worth considering.

What's Next

In the final article of this series, we assimilate the strategies covered in this series and share implementation tips. Think of it like making a soup where each person has a “special” recipe – it's all about finding what works best for you (and your target customers). With the knowledge you have gathered, you can then set your prices with greater confidence!

Subscribe so you don’t miss the final article in this series.